Welcome

Hey there Early Stagers…

This week we dive into the realms of innovation and defensibility. This week’s newsletter will share with you a new kens through which you can view the world that will help you identify innovation opportunities and enable you to predict the future.

We also talk about 17 strategies you can take to build defensive moats around your startup to help protect it from competition.

So take a zip of that coffee and let’s dive in…

Yours truly,

Avinoam

Never miss an update

Do you like what you read? Subscribe to our FREE weekly newsletter and join hundreds (soon we’ll get to thousands) of early stage founders just like you trying accelerate their PMF journey

Stacking Innovations

Have you ever thought about what enables the boom that we’re seeing in Generative AI? You can argue that OpenAI’s introduction to ChatGPT, along with the rising popularity of Midjourney and other similar tools opened the appetite and imagination of entrepreneurs.

But I would argue that there is something much deeper at play…

The reason why such technologies are only recently gaining popularity is because that up until recently, certain conditions haven’t been met to enable that rise.

If you look back at GenAI history (here’s a great summary video) you’ll see that the models were around long before ChatGPT became so popular, but there was a technological gap that prevented the required scale that enables the performance we see today.

The same concept is true for every technological innovation we know today.

Every new technology is created (or supported, depending how you want to look at things) by some other underlying technology that is enabling it.

Technology Stacks

To enable a car to drive autonomously you need Lidars, cameras, GPS, maps, SW and a lot of computing power. All of which needs to come together to enable a car to drive on its own.

To enable AI we need the models, we need training data, and again, a lot of computing power.

And if you want to go way back, to enable the invention of the car, we needed to be able to make engines, gears, fuel. Many prerequisite technologies or capabilities that had to exist so we can have our car.

Every new capability allow for a better one to be created. This is called a technology stack, and it’s a common concept in SW, but it’s applicable to almost any field.

The Common Stack

If you look at a common stack, what you will find is a list of layers that gradually simplify the process of using the underlying layers. This simplification allows for broader innovation and an expansion of capabilities as more people are able to “tinker” with the technology.

Here’s an example from the SW world:

- The basis for every SW is a piece of HW called a computer. We can dive deeper and say a processor, and a memory etc. but for simplicity, let’s start here.

- On top of the HW there is a piece of SW called an operating system. It’s role is to simplify the usage of the underlying HW.

- To extend the capabilities of the operating system, a programing language was developed so human can interact with the SW.

- Over time these languages evolve to become more and more abstract. Becoming more intuitive for humans, making it easier for us to code.

- This required another abstraction layer between the SW and us people.

Can you see how every step is built on top of its predecessor?

Every step allows for more capabilities and greater ease of use, opening the door for more people to create more innovation.

If we take a birds eye view and try to generalize the concept, we end up with just a 3 types of layers:

- The bottom (and most basic) layer is the enabling layer (usually a piece of hardware but can also be an algorithm like in the case of AI). This layer is usually formed when some fundamental technological breakthrough is achieved. This layer is the technical driving force that enable the entire stack to exist.

- The second layer is the connecting layer (in today’s world this is usually software) that simplifies the usage of the enabling layer. This can be a stack by itself with many layers of abstraction like we see in the coding languages example.

- And the last layer is what I call the Applications layer. This is where all the underlying layers are in place, making it is easy to harness the capabilities of the underlying tech without even understanding how it works (this is where AI is today and this is the reason for the recent boom we see in that field).

By stacking these types of layers we can pretty much explain every tech evolution in history. Which is why understanding it is the key for predicting the future…

Predicting Innovation

We can use the concept of layers described above to predict the next wave of innovations in any field. All we need is to identify fundamental breakthroughs or changes in a field and ask three simple questions:

- How can I make this more accessible?

- What else is needed for this to be useful?

- What problems can I solve with this?

- and a bonus question: What new opportunities this change brings? (more relevant for new regulation and fundamental changes, less for tech breakthroughs)

Let’s use this model to analyze a few close innovations:

How can I make this more accessible?

Back in 2021 Mark Zuckerberg announced Meta, making a huge bet on virtual reality and the Metaverse. Since then the hype around the Metaverse had subsided as the popularity of the tech has yet to come.

If I’d have to guess the reason for why the Metaverse is not what Mr Zuckerberg had thought it would be, it would be due to lack of accessibility. You need a VR device which is not cheap and not also easy to handle (wires, battery life, content etc.).

If this technology is going to reach massive adoption, it needs a lot of help becoming more accessible. This can be a huge opportunity for the company who can deliver.

What else is needed for this to be useful?

In a time when Bitcoin is reaching another peak, it’s hard not to notice how little did blockchain technology contribute to our lives.

It started with cryptocurrency, continued to smart contracts and web3.0 but the sad reality is that other than crypto, blockchain has yet to find a game changing application.

It’s not that the technology is bad. Maybe it just haven’t found the right application yet, but to me it’s seems like something is missing that prevents it from going mainstream.

It’s not that we haven’t tried. People tried security, tokenization and ownership trailing applications and even art, but nothing seems to stick.

What problems can I solve with this?

This is where I can’t think of a better example than AI. It looks like everywhere you look there’s a new AI application and people are trying to use it for new applications each and every day.

What to Take From All of This?

Recently I’ve been seeing frameworks everywhere. Ever since this stack concept came to my mind it’s like I’m seeing the world through a new lens. This lens allows me to look at an industry and assess where it is in its evolution.

You can (and should) use this framework in your ideation phase to try and identify exciting opportunities for a new startup. I think that the highest potential for a great startup is right at the time when an industry shifts between one layer to the next one.

It’s all about identifying where and when the next wave would hit and then riding it to your startup success.

The Cost of Scaling

In the exhilarating journey from conception to scale, early-stage founders are often so captivated by their idea’s potential that they overlook a crucial aspect of their venture’s future: the cost of scaling.

This oversight can lead to underestimating the resources required for growth, ultimately hindering their business’s long-term success.

To navigate this complex landscape, it’s essential to understand the unique scaling costs/challenges associated with different business models: service businesses, agencies, physical product-based businesses, brick-and-mortar operations, and digital businesses, such as Software as a Service (SaaS) companies.

Service Business: Scaling Personal Touch

Service businesses thrive on personal interaction and customized solutions. Your customers expect that a seasoned professional will provide the service they are paying for and often expect that the face of the business will be that person, which is not something that you can scale.

Scaling such businesses often means building a fool-proof system for providing the quality service you aspire to deliver and then expanding the team to maintain the level of service that clients expect. However, the challenge lies in the costs associated with hiring, training, and retaining quality staff.

Furthermore, this is a high touch type of business which mean the human interaction is a big part of the business. As you scale, maintaining the quality of service that set you apart can become increasingly difficult and costly, as it may involve investing in continuous training and potentially higher wage demands to retain top talent.

Agency: Balancing Creativity and Growth

Agencies, which often operate in fields such as marketing, advertising, and consulting, face a similar dilemma to service businesses. The core of their value proposition is creativity and strategic insight, which are inherently human-centric qualities.

Scaling an agency involves not just adding more people, but finding and nurturing talent that can uphold the agency’s creative standards. This necessitates significant investment in talent acquisition, culture building, and scalable processes that allow for creative freedom while ensuring efficiency and consistency in delivery.

This is rapidly changing with progress of generative AI, but many customers are still concerned about the quality and authenticity of the technology so there is still a big focus of human touch.This means that scaling an agency is still a costly endeavor.

A Hardware Based Business: The Logistical Puzzle

Scaling a physical product-based business (or a hardware based business) introduces complexities in manufacturing, inventory management, and distribution. The costs here are multifaceted: from sourcing materials in larger quantities (potentially at better rates but with higher upfront costs) to investing in manufacturing capacity and navigating the logistical challenges of distribution.

Additionally, as you scale, the need for quality control and after-sales support becomes more pronounced, requiring further investment to maintain customer satisfaction and brand integrity.

And we haven’t even talked about the cost of generating MVPs, and iterating on product improvements. When we put it all together, hardware is a tough business to build.

Digital Business (SaaS): Scaling Infrastructure and Customer Acquisition

SaaS companies, while not burdened by the physical constraints of traditional businesses, face their own scaling challenges. Infrastructure costs can grow exponentially as user bases increase, necessitating investments in cloud services, data security, and compliance.

Moreover, customer acquisition costs can skyrocket if not managed carefully, with increasing emphasis on marketing and sales spend to drive growth.

However, SaaS businesses also benefit from scalability advantages, such as the ability to serve global markets without proportional increases in costs, offering a unique leverage point. This is the preferred business model for many VCs as it have a lot of advantages when it comes to scaling.

Assessing the Cost of Scaling

If you want to successfully build a startup you must be able to realistically assess your growth and scale costs. To accurately assess the cost of scaling, founders must develop a deep understanding of their business model, market dynamics, and the specific challenges they will face at different stages of growth.

This involves creating detailed financial models that account for the incremental costs of scaling, potential revenue growth, and the capital required to sustain operations until the business can self-fund its expansion.

When you go out and search for investors money, it’s a zero sum game where you have to raise enough money to hit your next growth milestone in order to show continuous growth for the next round of investors.

If you are unable to reach that next growth milestone, the result might be devastating as down rounds can deter investors and signal your startup demise.

Attracting VC Investment

Each business model has its nuances and suitability as a startup venture.

- Service businesses and agencies, with their reliance on human capital, offer the potential for high margins but require careful management of growth to maintain quality.

- Physical product-based and brick-and-mortar businesses demand significant upfront investment but can achieve substantial scale if they successfully navigate the operational complexities.

- Digital businesses, particularly SaaS companies, stand out for their scalability and global market potential, making them particularly attractive to venture capital (VC) investors.

VCs are typically drawn to businesses with high growth potential, scalable models, and large addressable markets. Hence, digital businesses, especially SaaS companies, often become prime candidates for VC investment due to their lower marginal costs of scaling and the potential for exponential growth.

However, the attractiveness of a business to VCs also depends on the team’s strength, the innovation’s defensibility, and the founders’ vision and execution capabilities.

In conclusion, understanding and planning for the cost of scaling is crucial for any startup, regardless of the industry. Founders must approach this challenge with a clear strategy and a deep understanding of their business model to navigate the growth phase successfully.

While all business types have the potential to scale, digital businesses, with their inherent scalability, often stand out as both viable startup ventures and attractive targets for VC investment.

Never miss an update

Do you like what you read? Subscribe to our FREE weekly newsletter and join hundreds (soon we’ll get to thousands) of early stage founders just like you trying accelerate their PMF journey

17 Ways to Defend Your Startup

Recently I have been talking to many early stage founders and found that one of the major concern they hear from investors is the ability to defend their tech/product business advantage. The rise of AI and the ability of large enterprises to out-compete smaller startups is becoming a big concern and many investors are putting an emphasis on defensibility.

Furthermore, in the competitive arena of business, defense mechanisms are not just safeguards; they are essential strategies that ensure longevity, profitability, and innovation. From startups to established conglomerates, the ability to defend against market encroachments, technological disruptions, and evolving consumer preferences is what separates fleeting successes from enduring legacies.

We can categorize these defenses into several key areas, each is important on its own and can add value to your startup.

Technological Innovation

Innovation is the linchpin of competitive defense. By continuously evolving and improving products or services, businesses can maintain a cutting edge that rivals find difficult to replicate.

This involves not only the development of new technologies but also the improvement of existing processes and services to enhance efficiency, user experience, and overall value proposition.

Example: Nvidia’s dominance in the GPU market has given it the ability to sell its products at a high margin and maintain its business dominance.

Brand Loyalty

A strong brand acts as a formidable barrier to entry. Brand loyalty is cultivated through consistent customer satisfaction, emotional engagement, and the development of a brand identity that resonates deeply with the target market.

A loyal customer base is less susceptible to competitors’ advances, providing a steady revenue stream and word-of-mouth promotion.

Example: Nike’s brand, synonymous with athletic excellence and inspirational marketing, has built a loyal global following that transcends the mere utility of its products.

Content and Community

Similarly to brand loyalty, building a community is a very strong competitive advantage and can act as a strong defense mechanism.

Developing unique content and fostering a dedicated community can create a strong emotional connection with users, making it harder for competitors to lure them away. This is especially relevant for platforms that rely on user-generated content or that are built around specific interests or industries.

Example: Reddit has cultivated a vast network of communities across countless topics, creating a unique value proposition for its users that’s difficult for new platforms to replicate.

Scale Economies

Achieving scale can provide significant defensive advantages. Larger businesses benefit from lower per-unit costs due to higher production volumes, better negotiation power with suppliers, and the ability to spread fixed costs over a larger output.

This allows them to compete on price and invest in areas like R&D and marketing more aggressively than smaller rivals.

Example: Walmart leverages its enormous scale to offer lower prices than competitors, making it difficult for new entrants to compete in the retail space.

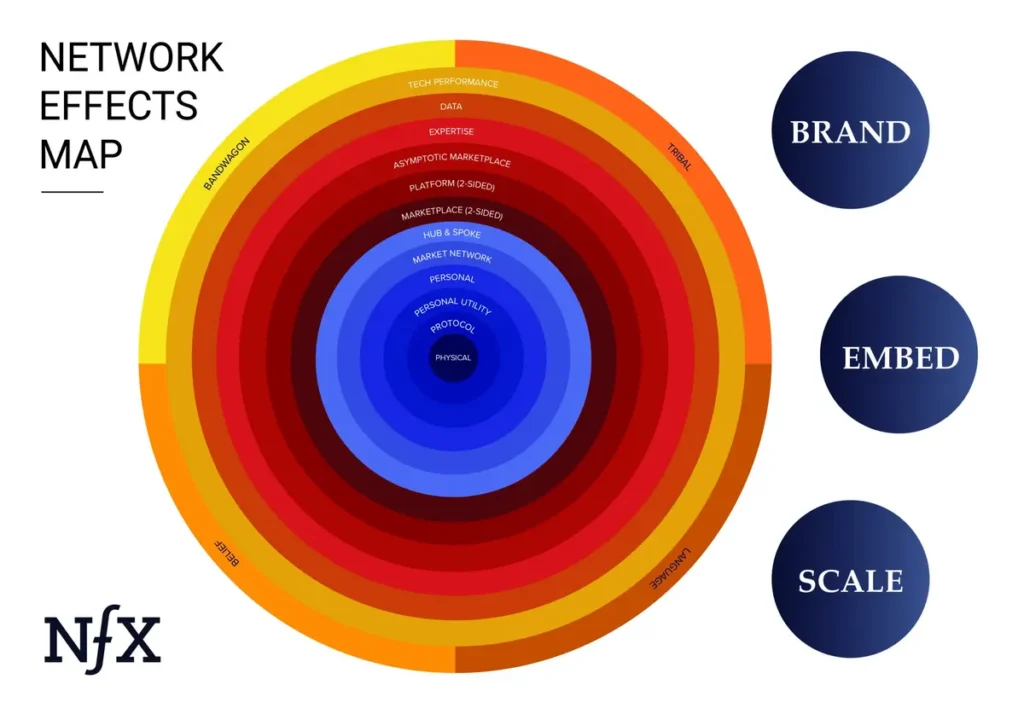

Network Effects

Network effects occur when the value of a product or service increases for all users as more people use it. This can create a self-reinforcing cycle that attracts more users, further entrenching the company’s market position. Network effects can be direct (as with social media platforms) or indirect (as in the case of software ecosystems).

Example: Facebook’s value to its users increases with the number of connections within the network, creating a formidable defense against new social media platforms. You can completely copy Facebook’s site but it will have no value without it’s users…

Regulatory Protection

In some industries, regulatory barriers can provide significant defense against competitors. This can include licenses, patents, and compliance with industry-specific regulations that are difficult and costly for new entrants to navigate.

Example: Pharmaceutical companies benefit from patent protection for new drugs, giving them exclusive rights to market these drugs for a period, allowing them to recoup R&D investments and earn profits.

Strategic Resource Control

Controlling key resources, whether they are physical (like rare minerals), intellectual (such as proprietary research), or human (expert talent), can offer a critical defense against competitors.

Securing access to these resources can prevent rivals from developing similar products or services.

Example: Tesla’s early investment in building a vast network of Superchargers has given it an edge in the electric vehicle market, where charging infrastructure remains a significant barrier for competitors.

Another great example is medical startup’s ability to tap into medical data to build and train AI models. A startup with such access to data will have a huge competitive advantage.

Data Moats

Similarly to controlling a strategic resource, controlling access to unique data can be a great defense mechanism.

A data moat occurs when a company has access to a unique, vast, and growing dataset that can be used to improve products, personalize services, and create barriers to entry for competitors. The more data a company collects, the better it can become at offering tailored solutions, thereby attracting more users and creating a cycle that is difficult for newcomers to break.

Example: Google’s search engine continuously improves through the data it collects from billions of search queries, making it increasingly difficult for new entrants to match its level of service. Also, medical startups often contract unique access to medical records.

Customer Lock-in/High Switching Costs

Creating high switching costs can effectively retain customers by making it costly or cumbersome for them to move to a competitor. This can be achieved through long-term contracts, proprietary technology that does not easily integrate with other systems, or by offering a product or service ecosystem that becomes embedded in the customer’s operations or lifestyle. The key here is to make it super easy to start adopting your product but very hard to switch to another.

Example: Adobe’s Creative Cloud suite has become deeply integrated into the workflow of creative professionals, making the cost of learning new software and transferring files a significant barrier to switching.

Unique Culture and Talent

A company’s culture and the talent it attracts can also serve as a form of defensibility. Companies known for their innovative culture, leadership, and ability to attract top talent will likely continue to innovate and stay ahead of the curve, creating a competitive edge that is difficult to replicate.

Example: Pixar’s unique culture of creativity and innovation, combined with its ability to attract and retain top animation talent, has made it a leader in the animation industry.

First-mover Advantage

Being the first to market with a new product or service can provide a temporary defensive position. The first mover can establish brand recognition, secure key distribution channels, and accumulate valuable customer feedback before competitors enter the market.

It’s important to note that this is also the riskiest defense strategy as competitors can easily learn from your mistakes and improve on your product. To fully utilize this mechanism you need to adopt a quick learning and improvement culture that will benefit and accelerate your competitive advantage by learning insights from the close (and unique) engagement with the market.

Example: Amazon’s early entry into e-commerce allowed it to establish a dominant brand, build a vast distribution network, and collect valuable consumer data, positioning it well ahead of later entrants.

Vertical Integration

Owning several or all of the steps in your production or distribution process can offer significant competitive advantages, from reducing costs to increasing control over the quality and supply chain.

This integration can create barriers for competitors who are unable to match the efficiency or quality control of vertically integrated firms.

This is a defense mechanism that is not appropriate to small startups as controlling multiple steps of a production or distribution chain require a large and complex operations which is more appropriate in a large enterprise.

Example: Tesla’s control over its entire production line, from batteries to final assembly, allows it to innovate rapidly and reduce reliance on external suppliers.

Another great example is Applied Materials which has products for almost all the required steps in the semiconductor’s manufacturing process. This gives Applied unique insights and capabilities that are only possible due to that expansive reach into the different process stages.

A Closed Platform Ecosystems

Building a closed platform ecosystem that brings together various products, services, and users can create a powerful network effect and lock-in. As more developers create applications and more users engage with the ecosystem, it becomes increasingly valuable and difficult for competitors to challenge.

Example: Apple’s iOS ecosystem, including the App Store, offers users and developers a comprehensive and integrated experience that competitors find challenging to replicate fully.

Superior Customer Experience

Offering an unparalleled customer experience can set a company apart from its competitors. This includes everything from the initial user interface and ease of use to customer support and after-sales service.

A superior customer experience can foster loyalty and word-of-mouth referrals, creating a competitive moat that is difficult for rivals to breach.

Example: Zappos.com, an online shoe and clothing retailer, differentiated itself by offering exceptional customer service, including free returns and a 365-day return policy, fostering strong customer loyalty.

Strategic Partnerships and Alliances

Forming strategic partnerships and alliances can enhance a company’s offerings, extend its market reach, and block competitors. These partnerships can be with suppliers, distributors, or even complementary businesses, creating a network that supports mutual growth and market defense.

Example: Spotify’s partnerships with mobile carriers and hardware manufacturers have expanded its reach and embedded its streaming service into a wide array of devices and platforms.

Owning a Cause

Committing to strong environmental, social, and governance (ESG) principles can not only enhance a company’s brand and appeal to consumers but also create a defensible position in markets where consumers increasingly value sustainability and ethical practices.

When customers associate a big cause that they feel connected with your brand which serve as a strong differentiator and defense mechanism for your company.

Example: Patagonia’s commitment to environmental sustainability and ethical manufacturing has engendered deep loyalty among its customer base, distinguishing it from competitors in the outdoor apparel market.

Leveraging Social Proof and Influencer Partnerships

Social proof, through user reviews and influencer partnerships, can significantly influence consumer behavior and brand perception.

A strong presence of positive social proof can deter customers from considering competitors.

Example: Glossier, a beauty brand, has effectively used social media and influencer partnerships to build its brand and foster a loyal customer base, leveraging the power of social proof to stand out in a crowded market.

Network Effects

A network effect is a phenomenon where a product or service becomes more valuable to its users as the number of users increases. This concept is foundational to the success of many digital platforms and is a powerful driver of growth and competitive advantage in the modern economy. At its core, the network effect is about value creation and amplification through user interconnectivity.

When a network effect is in play, each new user who joins the network enhances the product’s utility not just for themselves but for all existing users. This could be direct, as seen in communication services like WhatsApp or social networks like Facebook, where the value of being part of the network is literally about how many people you can connect with.

Alternatively, it could be indirect, where the growing user base attracts complementary services or products, thereby increasing the original product’s value. A classic example of indirect network effects is the relationship between video game consoles and the availability of games: more console users attract more game developers, which in turn draw in more users.

The beauty and power of network effects lie in their self-reinforcing nature. As more users join the network, the service becomes more attractive to potential new users, creating a positive feedback loop that can lead to exponential growth.

However, achieving and sustaining network effects can be challenging, as it often requires a critical mass of users to kick-start the cycle. Once established, though, network effects can create significant barriers to entry for competitors, as displacing an incumbent with a strong network effect requires not just matching but significantly exceeding the incumbent’s value proposition.

In essence, network effects underscore the importance of user base in the digital age, where the inter-connectivity of users can turn a useful product into an indispensable one, weaving it into the fabric of daily life and communication.

NfX has done a great job breaking down the different types of network effects. Here is a great article by them, describing the 16 types they have identified